car lease tax california

A car lease acquisition cost is a fee charged by the lessor to set up the lease. Californias Vehicle Leasing Act Civil Code 29857 2993 is the California supplement to the federal Consumer Leasing Act 15 USC.

How To Help Your Customers Calculate A Lease Payment Dealer Inspire

So if your payment is 300month you will actually pay 2850.

. Of the 725 125 goes to the county government. The 10 day window is the easiest way to execute the transaction with the DMV. The California State Board of Equalization Board has promulgated Regulation 1660 which explains the law as it applies to leased property in general and transactions that may look like.

The business deduction is three-quarters of your actual costs or 6000 8000 075. For vehicles that are being rented or leased see see taxation of leases and rentals. More simply you can take a flat-rate deduction for every.

The local government cities and districts collect up to 25. This means you only pay tax on the part of the car you lease not the entire value of the car. Remember automobile sales tax is collected by the DMV on behalf the tax authorities in.

The sales tax also. By Hearst Autos Research. A CDTFA 1138 is required.

You pay sales tax on each payment. This page describes the taxability of. Add Sales Tax to Payment.

For leased vehicles the limit on the monthly lease payment you can deduct is 800 per month plus hst which equates to a maximum of 9600 in tax-deductible expenses. 8010 Completing the Report of Sale-Used Vehicle REG 51 8015 Corrections on the Report of Sale-Used Vehicle REG 51. This page covers the most important aspects of Californias sales tax with respects to vehicle purchases.

When you lease a car you pay the Title and Registration fees but not that 2850 sales tax. 8005 Collection of California Sales Tax. For example if you previously paid 1500 sales or use tax to another state for the purchase of the vehicle and the California use tax due is 2000 the balance of use tax due to California would.

Sales tax is a part of buying and leasing cars in states that charge it. The most common method is to tax monthly lease payments at the local sales tax rate. The California vehicle tax is 75 percent but this simple number only gives you a rough idea of what youll really pay for a.

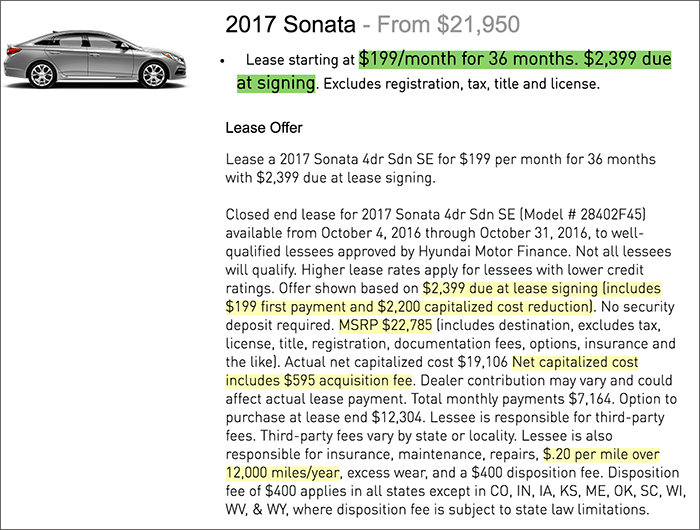

Acquisition Fee Bank Fee. In CA you have 10 days to transfer the title to the new owner with all fees paid in order to not pay taxes on lease buyout gluck December 26 2018 1142pm 8 No you dont. Sales tax in California varies by location but the statewide vehicle tax is 725.

As a motor vehicle dealer your sales of eligible buses to qualifying purchasers are subject to tax at a reduced rate of 33125 percent 725 percent current statewide tax rate less the 39375. How Much Is the Car Sales Tax in California. Multiply the base monthly payment by your local tax rate.

While Californias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Things to consider before leasing. For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699.

Its sometimes called a bank fee lease inception fee or administrative charge. Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off. 4010 Calculating Use Tax Amount.

If you dont buy the vehicle at the end of the lease you may have to pay a disposition fee to return the vehicle. Like with any purchase the rules on when and how much sales tax youll pay when you lease a car vary by. Each application subject to use tax must show the purchase price on the back of the Certificate of Title or include a bill of sale.

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High Mileage Lease Right For Me

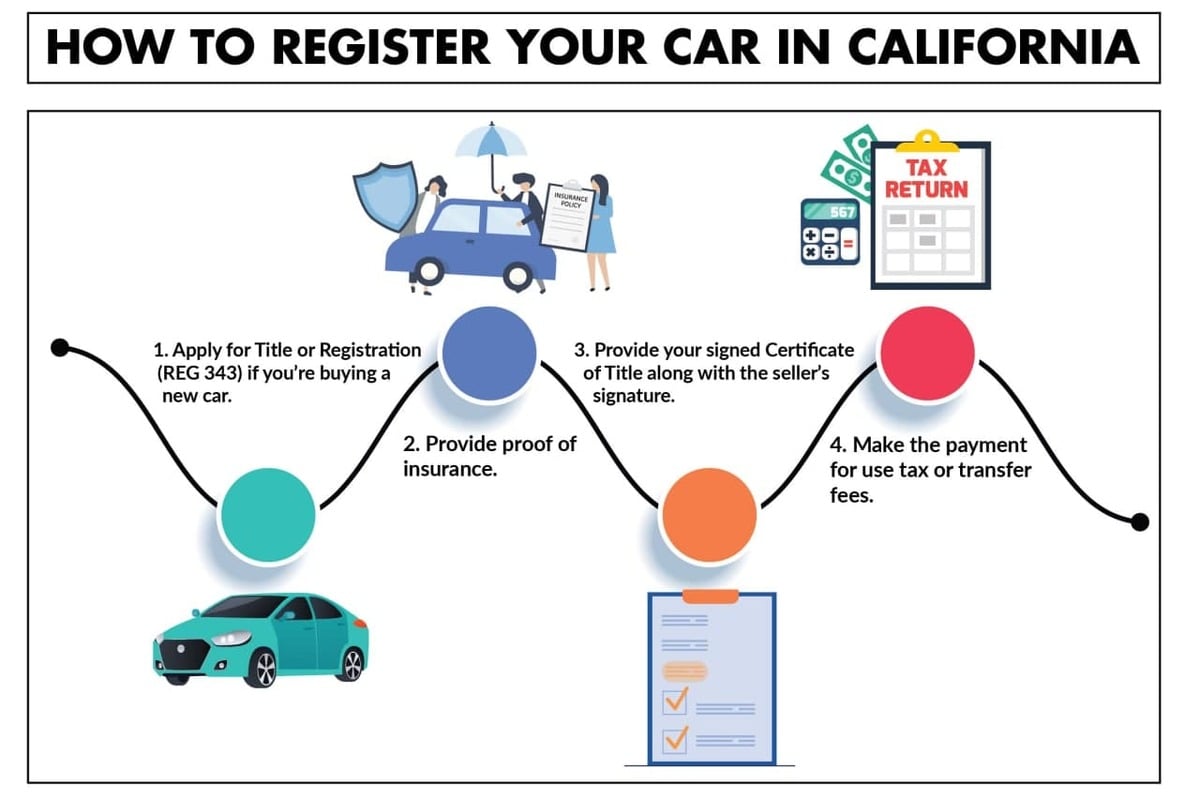

Moving To California Driver S License And Car Registration

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

California Vehicle Sales Tax Fees Calculator

Consider Selling Your Car Before Your Lease Ends Edmunds

Company Cash Allowance Vs Company Car Vanarama

What S The Car Sales Tax In Each State Find The Best Car Price

Lease Payment Formula Explained By Leaseguide Com

California Vehicle Tax Everything You Need To Know

Do Auto Lease Payments Include Sales Tax

Car Tax By State Usa Manual Car Sales Tax Calculator

Quickly Figure Out If Your Lease Deal Is Good

Car Leasing Costs Taxes And Fees U S News